- Learn

- Plan

- Invest

- Investor corner

- Distributor Corner

- Distributor Empanelment

- Code of contact

- SEBI Mutual Fund Regulations

- NISM Test Material

- Online services

- Distributor Login

- Disclosures of Commission

- Downloads

- Know Your Distributor

- Transaction charges & related info

- AMFI Circulars

- Distributor Query/ Feedback

- Distributor Master

- Ready Reckoner for mutual fund distributors

- Generate Transaction Link

- Promotional Material

- Shareholder Corner

- Edit NFC Card

- Careers

- PMS

- Invest Now

- About Us

- Contact Us

What is Shriram Money Market Fund?

Shriram Money Market Fund (SMMF) is an open-ended debt scheme with an investment objective of generating regular income through investment in a portfolio comprising of money market instruments with residual maturity up to 1 year.

Why Shriram Money Market Fund (SMMF)?

Seeks to invest primarily in money-market instruments with relatively higher credit rating, from a carefully selected universe.

May be used for up to 1-year financial goals, depending on investor objectives and risk profile.

No lock-in and no exit load, allowing investors to access or park money based on their short-term investment horizon.

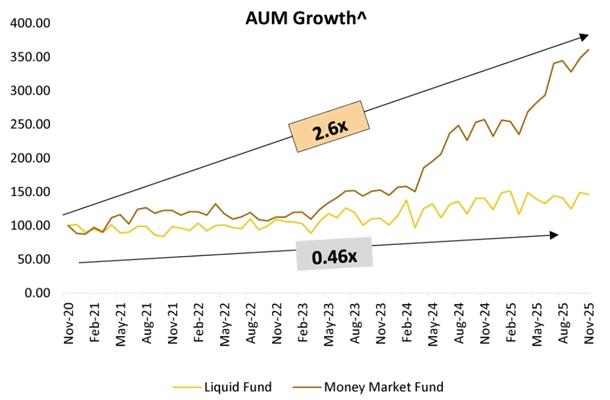

Money Market Funds Witness Rising Allocations

AUM of Money Market Fund category grew by 2.6x whereas Liquid Fund category grew by 0.46x

AUM of Money Market Fund grew to ₹ 3,57,101 Crore, accounting for 18% of total Debt Funds AUM*

Benefits and Suitability

No exit load. Invests in money-market instruments with maturities up to one year. Aims to maintain a portfolio with an average maturity up to 1 year.

High-quality short-term securities. Carefully crafted universe of money market instruments.

Attempts to provide a relatively better risk—return profile compared with traditional short-term alternatives.

Efficient cash management vehicle with limited impact from interest rate changes.

This fund can be used for STP (Systematic Transfer Plan) to other funds, allowing investors to transfer a fixed amount at regular intervals.

Fund Information

Fund name

Shriram Money Market Fund

Fund category

Money Market Fund (Debt Scheme)

Benchmark

NIFTY Money Market Index A-I

Fund type

An open-ended debt scheme investing in money market instruments. A relatively low-interest rate risk and moderate credit risk

Scheme objective

The investment objective of the Scheme is to generate regular income through investment in a portfolio comprising of money market instruments with residual maturity up to 1 year. There is no assurance that the investment objective of the Scheme will be achieved.

Lock in plan/option

Regular Plan and Direct Plan

Fund manager

Mr. Amit Modani and

Mr. Sudip Suresh More

Minimum Application Amount (Lumpsum)

Rs. 1,000 and in multiples of Re. 1/- thereafter

Minimum Amount (Per SIP Installment)*

(i) Rs. 500/- and in multiples of Re. 1/- thereafter for minimum 24 installments

(ii) Rs. 1000/- and in multiples of Re. 1/- thereafter for minimum 12 installments

Maximum: No Limit

Exit load

Nil

This product is suitable for investors who are seeking*

- Regular income over short term

- To generate income by investing in money market instruments

Investors should consult their financial advisers if in doubt about whether the product is suitable for them**.

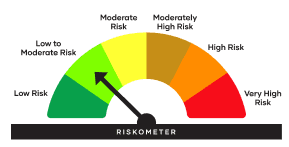

Riskometer

Investors understand that their principal will be at low to moderate risk

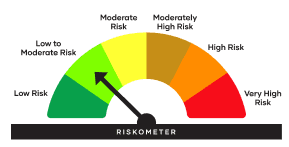

Benchmark Riskometer

Benchmark Riskometer is at low to moderate risk

As per AMFI Tier 1 Benchmark i.e Nifty Liquid Index A-I| Credit Risk / Interest Rate Risk | Relatively Low (Class A) | Moderate (Class B) | Relatively High (Class C) |

|---|---|---|---|

| Relatively Low (Class I) | - | B-I | - |

| Moderate (Class II) | - | - | - |

| Relatively High (Class III) | - | - | - |

B-I - A Scheme with Relatively Low Interest Rate Risk and Relatively Moderate Credit Risk

Fund Management

Mr. Amit Modani

Sr. Fund Manager

Mr. Amit Modani

Sr. Fund ManagerWork Experience

13+ yearsFund Managed

06

Mr. Sudip Suresh More

Fund Manager

Mr. Sudip Suresh More

Fund ManagerWork Experience

19+ yearsFund Managed

06

Mr Deepak Ramaraju

Managing this fund since

Mr. Deepak Ramaraju is a highly experienced Senior Fund Manager at Shriram Asset Management Company Ltd, with over two decades of diversified experience under his belt. He holds a degree in chemical engineering and has been associated with equity markets for the past 16 years. Before joining Shriram Asset Management Company, Mr. Deepak was part of the global equity research team and advised the Sanlam Group of South Africa on their India-focused fund. Prior to his stint in the financial industry, Mr. Deepak worked as a researcher and co-inventor at GE India Technology Center, Bangalore. During his time there, he was credited with 10 patents, highlighting his expertise and innovative abilities. His diverse background and extensive experience make him a valuable asset to the Shriram Asset Management team.

Funds managed by the fund manager

- Shriram Aggressive Hybrid Fund

- Shriram Flexi Cap Fund

- Shriram ELSS Tax Saver Fund

- Shriram Balanced Advantage Fund

- Shriram Multi Asset Allocation Fund

- Shriram Multi Sector Rotation Fund

Mr. Sudip Suresh More

Managing this fund since 03 Oct 24

Mr. Sudip Suresh More has around 19 years of experience in managing Fixed Income Investments, Macroeconomic Research and Credit Analysis. Prior to this assignment, Mr. Sudip Suresh More was Debt Fund Manager at Kshema General Insurance Company. Additionally, he has also worked with Sahara India Life Insurance Company Ltd as a Debt Fund Manager whereby managing ULIP and Traditional funds on Fixed Income side.

Funds managed by the fund manager

- Shriram Aggressive Hybrid Fund

- Shriram Balanced Advantage Fund

- Shriram Overnight Fund

- Shriram Multi Asset Allocation Fund

- Shriram Nifty 1D Rate Liquid ETF

- Shriram Liquid Fund

Mr. Prateek Nigudkar

Managing this fund since

Mr. Prateek brings over 13 years of experience in managing equity funds, as well as in quantitative and fundamental research. Before his current role, he served as the Fund Manager at Jio BlackRock Mutual Fund. He has also held the position of Fund Manager at DSP Mutual Fund. Earlier in his career, he worked as a Quantitative Analyst at State Street Global Advisors and Credit Suisse Business Analytics, India.

Funds managed by the fund manager

- Shriram Aggressive Hybrid Fund

- Shriram Flexi Cap Fund

- Shriram ELSS Tax Saver Fund

- Shriram Balanced Advantage Fund

- Shriram Multi Asset Allocation Fund

- Shriram Multi Sector Rotation Fund

Mr. Amit Modani

Managing this fund since 01 Nov 25

Mr. Amit Modani has over 13 years of experience in fixed income fund management and dealing. Before his current role, he served as Fund Manager - Fixed Income at Mirae Asset Investment Managers (India) Pvt. Ltd. He has also worked with BOI Mutual Fund. Prior to that, he worked as Portfolio Manager – Fixed Income at Quantum Mutual Fund and as Dealer – Fixed Income at PGIM Mutual Fund.

Funds managed by the fund manager

- Shriram Aggressive Hybrid Fund

- Shriram Balanced Advantage Fund

- Shriram Overnight Fund

- Shriram Multi Asset Allocation Fund

- Shriram Nifty 1D Rate Liquid ETF

- Shriram Liquid Fund

Frequently Asked Questions

What is Shriram Money Market Fund?

What is the Investment Objective?

What is the suitability of this scheme?

What is asset allocation of the fund?

Who is the Fund Manager of the scheme?

Disclaimer : NSE Indices Ltd Disclaimer: NSE INDICES LIMITED do not guarantee the accuracy and/or the completeness of the Index or any data included therein and NSE INDICES LIMITED shall have not have any responsibility or liability for any errors, omissions, or interruptions therein. NSE INDICES LIMITED does not make any warranty, express or implied, as to results to be obtained by the Issuer, owners of the product(s), or any other person or entity from the use of the Index or any data included therein. NSE INDICES LIMITED makes no express or implied warranties, and expressly disclaims all warranties of merchantability or fitness for a particular purpose or use with respect to the index or any data included therein. Without limiting any of the foregoing, NSE INDICES LIMITED expressly disclaim any and all liability for any claims ,damages or losses arising out of or related to the Products, including any and all direct, special, punitive, indirect, or consequential damages (including lost profits), even if notified of the possibility of such damages.

Risk Factors : The information contained in this document is compiled from third party and publicly available sources and is included for general information purposes only. There can be no assurance and guarantee on the yields. Views expressed cannot be construed to be a decision to invest. The statements contained herein are based on current views and involve known and unknown risks and uncertainties. Whilst Shriram Asset Management Company Limited (the AMC) shall have no responsibility/liability whatsoever for the accuracy or any use or reliance thereof of such information. The AMC, its associate or sponsors or group companies, its Directors or employees accepts no liability for any loss or damage of any kind resulting out of the use of this document. The recipient(s) before acting on any information herein should make his/her/their own investigation and seek appropriate professional advice and shall alone be fully responsible / liable for any decision taken on the basis of information contained herein. Any reliance on the accuracy or use of such information shall be done only after consultation to the financial consultant to understand the specific legal, tax or financial implications. For further information about other schemes (product labelling and performance of the fund) please visit the website of the AMC www.shriramamc.in. Please consult your financial advisor or mutual fund distributor before investing.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY