Shriram Multi Sector Rotation Fund

EquityDownloads

What is Sector Rotation?

Why invest in Shriram Multi Sector Rotation Fund?

Diversification of Risk

Focused 3 to 6 sectors in one fund

Avoid Sector Traps

Rotation across trending sectors

Tax efficient for Investor

No capital gains tax when fund manager rebalances

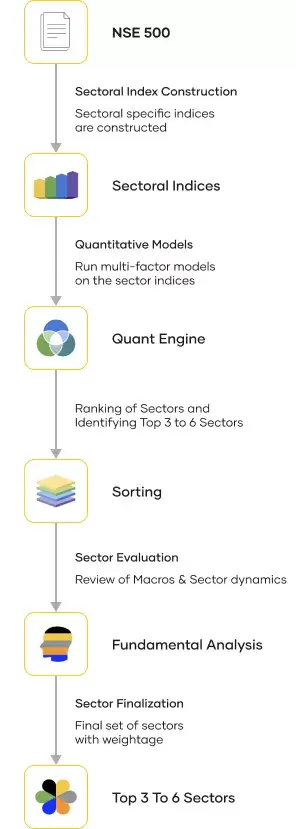

Investment Framework

This fund is ideal for you if you are looking for

Retirement Planning

Plan this GoalChild’s Education

Plan this GoalWedding Plan

Plan this GoalWealth Creation

Plan this GoalDream Home

Plan this GoalFund Details

Fund Information

Shriram Multi Sector Rotation Fund

Benchmark

Fund category

Equity – Sectoral / Thematic

Fund type

An open-ended scheme investing in equity and related instruments following multi sector rotation theme

Scheme objective

The investment objective of the scheme is to generate long-term capital appreciation by employing a quantamental approach of investing in equity and equity derivatives of specific sectors that are trending due to better earnings expectation. The allocation among sectors and stock selection will be decided by the in-house proprietary quantitative model and further augmented with fundamental analysis. There is no assurance or guarantee that the investment objective of the Scheme will be achieved.

Scheme Plans & Options

Regular Plan

- (i) Growth

Direct Plan

- (i) Growth

Fund manager

Mr. Deepak Ramaraju, Mr. Prateek Nigudkar

Minimum investment

Lumpsum: Re. 500/- and multiples of Re.1/- thereafter

Subsequent purchases: Minimum amount of Re. 500/- and multiples of Re. 1/- thereafter.

SIP : Weekly/Fortnightly/Monthly/Quarterly

- Rs. 500/- and in multiples of Re. 1/- thereafter for minimum 24 installments

- Rs. 1000/- and in multiples of Re. 1/- thereafter for minimum 12 installments

Exit load

Nil

exit within 365 days from the date of allotment (applicable Net Asset value)

Nil

For exit after 365 days from the date of allotment

This product is suitable for investors* who are seeking:

- Capital appreciation over medium to long term in an actively managed portfolio of equity & equity related instruments of specific identifiable sectors that are performing well

- Sustainable alpha over the benchmark

Riskometer

Investors understand that their principal will be at very high risk

Investors understand that their principal will be at very high riskBenchmark Riskometer

Benchmark Riskometer is at very high risk. As per AMFI Tier 1 Benchmark i.e Nifty 500 TRI

Benchmark Riskometer is at very high risk. As per AMFI Tier 1 Benchmark i.e Nifty 500 TRI

Fund Performance

Date of inception N/A | ||||||||

|---|---|---|---|---|---|---|---|---|

| AUM Rs.(in crore) | ||||||||

| Date | Period | Nav (Rs.) Per Unit | Scheme Returns (%) | Scheme Benchmark Returns (%) | Additional Benchmark (NIFTY50) Returns (%) | Current value of ₹ 10,000 invested | ||

| Scheme | Scheme Benchmark | Additional Benchmark (NIFTY50) | ||||||

Fund Portfolio

Fund Distribution

(As on 31 Jan 2026)

Legend:Equity

99.80 percent

Legend:Net Receivables / (Payables)

0.20 percent

Legend:

0.00 percent

Sector Allocation

(As on 31 Jan 2026)

Banks

22.42%

Telecom - Services

5.31%

Automobiles

7.58%

IT - Software

11.84%

Finance

6.07%

Holdings 40

| Name | Sector | Instrument | Assets |

|---|---|---|---|

| STATE BANK OF INDIA | Banks | Equity | 7.79% |

| BHARTI AIRTEL LTD | Telecom - Services | Equity | 5.31% |

| MAHINDRA & MAHINDRA LTD | Automobiles | Equity | 5.03% |

| AXIS BANK LTD | Banks | Equity | 4.43% |

| INFOSYS LTD | IT - Software | Equity | 4.25% |

Fund Management

Frequently Asked Questions (FAQs)

It is an open-ended scheme investing in equity and related instruments following the multi-sector rotation theme. Shriram Multi Sector Rotation Fund aims to provide diversification by focusing on 3 to 6 trending sectors within one fund, potentially reducing concentrated risks. The fund seeks to avoid sector traps by rotating across sectors that are expected to show better earnings, which may help minimize risks. It is designed to be tax-efficient, as no capital gains tax is incurred when the fund manager rebalances the portfolio, making it a potentially smart and efficient investment choice.