Shriram Liquid Fund

DebtDownloads

Reasons to Invest

Stability

The scheme would endeavour to invest in very short term debt and money market instruments upto 91 days which have a good credit quality and easy liquidity. The very short maturity of the securities helps minimize the MTM volatility in the portfolio thus minimizing capital risk

Liquidity

Offers high liquidity allowing investors to redeem investment on any given business day

Returns

Funds could potentially earn returns even for a day or the week-end

*Subject to cut off time for receipt of investment and redemption request. Exit load applicable on redemption within stipulated timeline, please refer SID for exit load. It is an endeavor to dispatch redemption proceeds on the next business day. Please note as per regulation, the redemption or repurchase proceeds shall be dispatched within 3 working days from the date of redemption or repurchase.

This product is suitable for investors who are seeking**:

- A stable, liquid alternative to traditional savings accounts

- Safety and liquidity for short-term funds

- Investors should consult their financial advisers if in doubt about whether the product is suitable for them**.

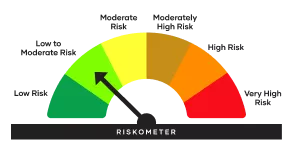

Riskometer

Investors understand that their principal will be at low to moderate risk

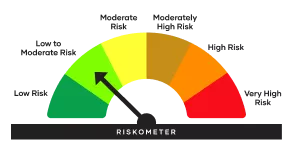

Investors understand that their principal will be at low to moderate riskBenchmark Riskometer

Benchmark Riskometer is at low to moderate risk As per AMFI Tier 1 Benchmark i.e Nifty Liquid Index A-I

Benchmark Riskometer is at low to moderate risk As per AMFI Tier 1 Benchmark i.e Nifty Liquid Index A-I

Fund Details

Fund Information

Benchmark

Fund Category

Fund Type

Scheme Objective

Scheme Option

Regular Plan (i) Growth

Direct Plan (i) Growth

Fund Manager

Minimum Investment

SIP:Monthly/Quarterly

Monthly: Rs. 1000/- and in multiples of Re. 1/- thereafter for minimum 12 installments

Quarterly: Rs. 3000/- and in multiples of Re. 1/- thereafter for minimum 4 installments23

| Exit Load | |

|---|---|

| Investor exit upon Subscription | Exit load as a % of redemption proceeds |

| Day 1 | 0.0070% |

| Day 2 | 0.0065% |

| Day 3 | 0.0060% |

| Day 4 | 0.0055% |

| Day 5 | 0.0050% |

| Day 6 | 0.0045% |

| Day 7 onwards | 0.0000% |

Fund Performance

Date of inception N/A | ||||||||

|---|---|---|---|---|---|---|---|---|

| AUM Rs.(in crore) | ||||||||

| Date | Period | Nav (Rs.) Per Unit | Scheme Returns (%) | Scheme Benchmark Returns (%) | Additional Benchmark (NIFTY50) Returns (%) | Current value of ₹ 10,000 invested | ||

| Scheme | Scheme Benchmark | Additional Benchmark (NIFTY50) | ||||||

Disclaimer: MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY. Past performance may or may not be sustained in future.The performance of the scheme is benchmarked to the Nifty Liquid Index A-I. The returns are simple annualised returns for less than 1 year. Different plans shall have a different expense structure. The performance details provided herein are of Regular Plan-Growth Option & Direct Plan-Growth Option. For computation of return since inception (%) the allotment NAV has been taken as Rs. 1000.00. Point-to-point returns is calculated on a standard investment of Rs. 10,000. Load is not considered for computation of returns. In case, the start/end date of the concerned period is a Non-Business Date (NBD), the NAV of the previous date is considered for computation of returns. The NAV per unit shown in the table is as on the start date of the said period. The scheme is currently managed by Mr. Sudip More (Since 14 November, 2024) and Mr. Amit Modani (Since November 01, 2025).

Fund Portfolio

Fund Distribution

(As on 31 Jan 2026)

Legend:Money Market Instruments- CP

22.71 percent

Legend:Money Market Instruments- T-Bills

22.70 percent

Legend:Money Market Instruments- CD

42.10 percent

Legend:Money Market Instruments- TREPS

12.23 percent

Legend:Corporate Debt Market Development Fund

0.27 percent

Legend:Net Receivables / (Payables)

-0.01 percent

Legend:

0.00 percent

Sector Allocation

(As on 31 Jan 2026)

CRISIL A1+

55.10%

Sovereign

22.70%

Others

12.49%

IND A1+

9.71%

Holdings 24

| Name | Sector | Instrument | Assets |

|---|---|---|---|

| SIDBI CP RED 12-02-2026 | CRISIL A1+ | Money Market Instruments- CP | 13.00% |

| 91 DAYS TBILL RED 26-02-2026 | Sovereign | Money Market Instruments- T-Bills | 12.98% |

| PUNJAB NATIONAL BANK CD 09-03-26 | CRISIL A1+ | Money Market Instruments- CD | 12.94% |

| TREPS_RED_02.02.2026 | Others | Money Market Instruments- TREPS | 12.23% |

| HDFC BANK CD RED 18-02-26 | CRISIL A1+ | Money Market Instruments- CD | 9.74% |

Fund Management

Frequently Asked Questions (FAQs)

Shriram Liquid Fund is an open-ended Liquid scheme with relatively low interest rate risk and moderate credit risk.