Invest systematically, calculate effectively with SIP calculator!

SIP Calculator

A Systematic Investment Plan (SIP) calculator is an online financial tool that can help to calculate the returns you would earn on your SIP investments.

Investment Summary

Disclaimer: Past performance may or may not be sustained in future and is not a guarantee of any future returns.

Detailed Year-wise Investment Summary

| Year | SIP Amount / Month | Invested Amount / Year | Total Invested Amount |

|---|

Disclaimer: This calculator is meant for investor education purpose only and not aimed at soliciting investments in any particular scheme of Shriram Mutual Fund. This material is created to explain basic financial / investment related concepts to investors. Mutual Fund does not provide guaranteed returns. Investors are advised to seek professional advice from financial, tax and legal advisor before investing.

Advantages of SIP calculator

Related Calculators

What is a SIP calculator?

An SIP calculator helps you estimate the future value of your investments made through a Systematic Investment Plan (SIP). Using this tool, you can plan your investment strategy and determine the amount of money you need to invest regularly to achieve your financial goals. It allows you to invest a fixed amount of money at regular intervals, such as monthly, rather than investing a lump sum amount at once. By doing so, you can take advantage of the benefits of compounding and investing in mutual funds, which can help grow your wealth over the long term. It can also help you compare different SIP options and choose the one that suits your needs the best. Overall, an SIP investment calculator is a useful tool that can help you make informed decisions and plan your financial future better.

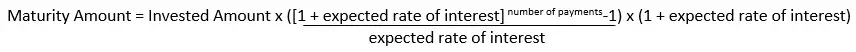

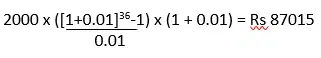

How do SIP calculators work?

You can invest a specific amount on a weekly, monthly, quarterly through SIPs. The SIP calculator considers the amount you invest, the number of years you wish to invest, and the expected rate of interest. With this information, the calculator will apply the following formula. -

For example:Maya wants to invest Rs. 2000 per month for 36 months. Her expected rate of return is 12% per annum. The SIP calculator considers the following factors:

Invested amount = Rs. 2,000 Number of payments = 10 Expected rate of interest per month= (12/100)/ 12 = 0.01

Maya's maturity amount after 36 months = Rs. 87,015

Please keep in mind that mutual funds are subject to market fluctuations and the maturity amount may be more or less than the amount given.

Here is an example to show how SIP calculator works:

Let's look at an example to help you understand this better.

Maya wants to invest Rs 2000 per month for 36 months. Her expected rate of return is 12% per annum.The SIP calculator takes into account these factors:

Invested amount = Rs 2000 Number of payments= 10 Expected rate of interest per month= (12/100)/ 12 = 0.01

Maya's maturity amount after 36 months will be

Please keep in mind that mutual funds are subject to market fluctuations and the maturity amount may be more or less than the amount given.

Frequently Asked Questions

SIP stands for Systematic Investment Plan. It is a way of investing in small amounts periodically instead of lump sums. In an SIP, you invest a fixed amount of money at regular intervals, such as monthly, quarterly, or annually.