Introducing

Shriram Money Market Fund

Unlock the true potential of your surplus money

What is Shriram Money Market Fund?

Shriram Money Market Fund (SMMF) is an open-ended debt scheme with an investment objective of generating regular income through investment in a portfolio comprising of money market instruments with residual maturity up to 1 year.

Why Shriram Money Market Fund (SMMF)?

Higher Quality Portfolio Mix

Seeks to invest primarily in money-market instruments with relatively higher credit rating, from a carefully selected universe.

For Up To 1-year Financial Goals

May be used for up to 1-year financial goals, depending on investor objectives and risk profile.

Ease Of Exit

No lock-in and no exit load, allowing investors to access or park money based on their short-term investment horizon.

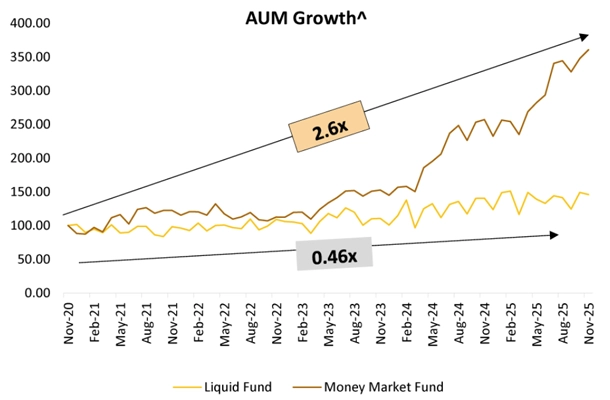

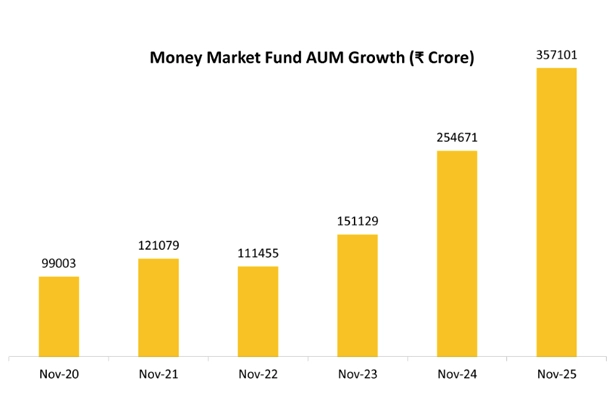

Money Market Funds Witness Rising Allocations

AUM of Money Market Fund category grew by 2.6x whereas Liquid Fund category grew by 0.46x

AUM of Money Market Fund grew to ₹ 3,57,101 Crore, accounting for 18% of total Debt Funds AUM*

Investors are increasingly allocating to Money Market Funds to capture opportunities from the lower interest rate cycle.

Source: AMFI Category-wise AUM Data (2021–2025) | * Data as on 30th November 2025 | ^ AUM rebased to 100

Benefits and Suitability

High Liquidity

No exit load. Invests in money-market instruments with maturities up to one year. Aims to maintain a portfolio with an average maturity up to 1 year.

High Quality Portfolio

High-quality short-term securities. Carefully crafted universe of money market instruments.

Aims For Better Risk Adjusted Returns

Attempts to provide a relatively better risk—return profile compared with traditional short-term alternatives.

Active Cash Management For Treasuries

Efficient cash management vehicle with limited impact from interest rate changes.

Suitable For STPs

This fund can be used for STP (Systematic Transfer Plan) to other funds, allowing investors to transfer a fixed amount at regular intervals.

Fund Information

Fund name

Shriram Money Market Fund

Fund category

Money Market Fund (Debt Scheme)

Benchmark

NIFTY Money Market Index A-I TRI

Fund type

An open-ended debt scheme investing in money market instruments. A relatively low-interest rate risk and moderate credit risk

Scheme objective

The investment objective of the Scheme is to generate regular income through investment in a portfolio comprising of money market instruments with residual maturity up to 1 year. There is no assurance that the investment objective of the Scheme will be achieved.

Lock in plan/option

Regular Plan and Direct Plan

Fund manager

Mr. Amit Modani and

Mr. Sudip Suresh More

Minimum Application Amount (Lumpsum)

Rs. 1,000 and in multiples of Re. 1/- thereafter

Minimum Amount (Per SIP Installment)*

i. Rs.500/- and in multiples of Rs.1/- thereafter for minimum 24 installments

ii. Rs.1000/- and in multiples of Rs.1/- thereafter for minimum 12 installments

Maximum: No Limit

Exit load

Nil

This product is suitable for investors who are seeking*

- Regular income over short term

- To generate income by investing in money market instruments

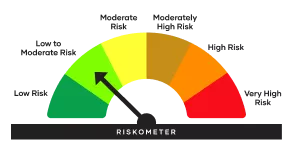

Riskometer

Investors understand that their principal will be at low to moderate risk

Investors understand that their principal will be at low to moderate riskBenchmark Riskometer

Benchmark Riskometer is at low to moderate risk. As per AMFI Tier 1 Benchmark i.e Nifty Liquid Index A-I

Benchmark Riskometer is at low to moderate risk. As per AMFI Tier 1 Benchmark i.e Nifty Liquid Index A-I

| Credit Risk / Interest Rate Risk | Relatively Low (Class A) | Moderate (Class B) | Relatively High (Class C) |

|---|---|---|---|

| Relatively Low (Class I) | - | B-I | - |

| Moderate (Class II) | - | - | - |

| Relatively High (Class III) | - | - | - |

B-I - A Scheme with Relatively Low Interest Rate Risk and Relatively Low Credit Risk.

Fund Management

Frequently Asked Questions (FAQs)

A Money Market Fund is an open-ended debt scheme that invests in money-market instruments with a maturity of up to one year.

Disclaimer : NSE Indices Ltd Disclaimer: NSE INDICES LIMITED do not guarantee the accuracy and/or the completeness of the Index or any data included therein and NSE INDICES LIMITED shall have not have any responsibility or liability for any errors, omissions, or interruptions therein. NSE INDICES LIMITED does not make any warranty, express or implied, as to results to be obtained by the Issuer, owners of the product(s), or any other person or entity from the use of the Index or any data included therein. NSE INDICES LIMITED makes no express or implied warranties, and expressly disclaims all warranties of merchantability or fitness for a particular purpose or use with respect to the index or any data included therein. Without limiting any of the foregoing, NSE INDICES LIMITED expressly disclaim any and all liability for any claims ,damages or losses arising out of or related to the Products, including any and all direct, special, punitive, indirect, or consequential damages (including lost profits), even if notified of the possibility of such damages.

Risk Factors : The information contained in this document is compiled from third party and publicly available sources and is included for general information purposes only. There can be no assurance and guarantee on the yields. Views expressed cannot be construed to be a decision to invest. The statements contained herein are based on current views and involve known and unknown risks and uncertainties. Whilst Shriram Asset Management Company Limited (the AMC) shall have no responsibility/liability whatsoever for the accuracy or any use or reliance thereof of such information. The AMC, its associate or sponsors or group companies, its Directors or employees accepts no liability for any loss or damage of any kind resulting out of the use of this document. The recipient(s) before acting on any information herein should make his/her/their own investigation and seek appropriate professional advice and shall alone be fully responsible / liable for any decision taken on the basis of information contained herein. Any reliance on the accuracy or use of such information shall be done only after consultation to the financial consultant to understand the specific legal, tax or financial implications. For further information about other schemes (product labelling and performance of the fund) please visit the website of the AMC www.shriramamc.in. Please consult your financial advisor or mutual fund distributor before investing.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY