Asset under management

Shriram Multi Asset Allocation Fund

Investment Objective

The primary objective of the scheme is to generate long term capital appreciation with inflation beating returns by investing in Equity and Equity related securities, Debt and Money Market instruments, Gold/Silver ETFs, and REITs/ InvITs. There is no assurance that the investment objective of the Scheme will be achieved

This fund is ideal for you if you are looking for

Why invest in Shriram Multi Asset Allocation Fund?

Risk adjustment: 3 Assets, 3 Benefits - Get the Upside of Equity, Stability of Debt, Protection of Gold.

Short investment period: Provides moderate volatility and reasonable returns over the medium to long term through diversified investments.

No entry/exit loads: Navigates different performance patterns of various asset classes influenced by economic cycles, global scenarios, and geopolitical events.

How to invest in Shriram Multi Asset Allocation Fund?

1

Register and create a folio by completing KYC verification and bank account authentication.

2

Select the mutual fund you wish to invest in, enter the amount you want to invest.

3

Make the payment.

4

Receive a confirmation of your investment.

How does the fund work

Amit and Radha dream of starting a business and want funds to fuel their dream.

They explore the Shriram Multi Asset Allocation Fund, which balances between long-term capital appreciation and lower volatility since the assets are spread across different asset classes.

Amit and Radha decide to invest in the mutual fund knowing it will fund their business dream.

Disclaimer: The performance of any mutual fund is subject to market risks and may vary from person to person. The above-mentioned story is for illustrative purposes only and should not be considered as a guarantee or assurance of the performance of any mutual fund. It is important to do your own research and consult with a financial advisor before making any investment decisions.

This product is suitable for the following investors* who want:

- Long term inflation-adjusted wealth creation through exposure to multiple assets i.e., Equity, Debt and Gold/Silver ETFs.

- To regularly invest over time through SIPs, top-ups or STP from liquid/overnight funds, to meet financial and family goals.

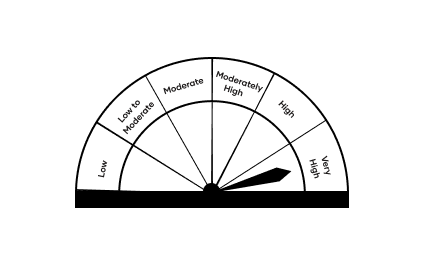

- Very high risk.

*Investors should consult their financial advisor if in doubt about whether the product is suitable for them.

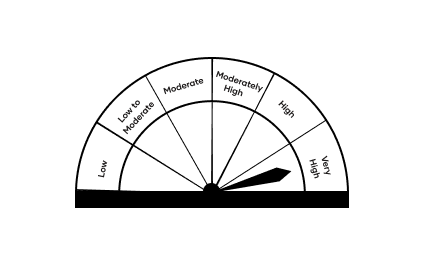

Riskometer

Investor understand that their principal will be at very high risk

Benchmark Riskometer

Benchmark Riskometer is at very high risk

*Investors should consult their financial advisers if in doubt whether the product is suitable for them

Fund Details

Lock-in period

No lock-in

Benchmark

Nifty 50 TRI (70%) + NIFTY Short Duration Debt Index (20%) + Domestic prices of Gold (8%) + Domestic prices of Silver (2%)

Inception Date

08-Sep-2023

Scheme options

Regular Plan

- (i) Growth

Direct Plan

- (i) Growth

Minimum Investment

₹ 5000

and in multiples of ₹1/- thereafter

Minimum Additional Purchase Amount:

₹ 5000

and in multiples of ₹1/- thereafter

Note: In accordance with the regulatory requirement, the minimum application amount and minimum redemption amount will not be applicable for investment made in schemes of the Fund in compliance with the SEBI circular no. SEBI/HO/IMD/IMD-I/DOF5/P/CIR/2021/553 dated April 28, 2021 read along with SEBI circular no. SEBI/HO/IMD/IMD- I/DOF5/P/CIR/2021/629 dated September 20, 2021.

SIP

Monthly

₹1000 and in multiples of Re. 1/- thereafter

Quarterly

₹3000 and in multiples of Re. 1/- thereafter

Entry load

There is no entry load

Exit load

If redeemed / switched-out within 90 days from the date of allotment:-

- Upto 12% of units: Nil

- More than 12% of units: 1% of applicable Net Asset Value (NAV)

If redeemed/switched-out after 90 days from the date of allotment: Nil

Expense ratio

2.25%

Regular Growth

0.45%

Direct Growth

Fund Performance

Performance of Shriram Multi Asset Allocation Fund - Regular Growth as of Apr 24, 2024

Returns of Direct Plan - Growth Option as on 24-Apr-2024 Date of inception 08-Sep-2023 | ||||||||

|---|---|---|---|---|---|---|---|---|

| NAV Rs. 12.31 | AUM Rs.(in crore) | |||||||

| Date | Period | Nav (Rs.) Per Unit | Scheme Returns (%) | Scheme Benchmark Returns (%) | Additional Benchmark (NIFTY50) Returns (%) | Current value of ₹ 10,000 invested | ||

| Scheme | Scheme Benchmark | Additional Benchmark (NIFTY50) | ||||||

| Oct 20, 2023 | Last 6 Month | 10.0252 | 22.76% | 12.31% | 15.01% | ₹12,276 | ₹ 11,231 | ₹ 11,501 |

| Apr 24, 2023 | Last 1 Year | NA | NA | NA | NA | NA | NA | NA |

| Apr 24, 2021 | Last 3 Year | NA | NA | NA | NA | NA | NA | NA |

| Apr 24, 2019 | Last 5 Year | NA | NA | NA | NA | NA | NA | NA |

| Apr 24, 2014 | Last 10 Year | NA | NA | NA | NA | NA | NA | NA |

| Sep 08, 2023 | Since Inception(08 Sep 2023) | 10.0000 | 23.07% | 12.31% | 13.43% | ₹12,307 | ₹ 11,231 | ₹ 11,343 |

Returns of Regular Plan - Growth Option as on 24-Apr-2024 Date of inception 08-Sep-2023 | ||||||||

|---|---|---|---|---|---|---|---|---|

| NAV Rs. 12.16 | AUM Rs.(in crore) | |||||||

| Date | Period | Nav (Rs.) Per Unit | Scheme Returns (%) | Scheme Benchmark Returns (%) | Additional Benchmark (NIFTY50) Returns (%) | Current value of ₹ 10,000 invested | ||

| Scheme | Scheme Benchmark | Additional Benchmark (NIFTY50) | ||||||

| Oct 23, 2023 | Last 6 Month | 9.9007 | 22.80% | 12.31% | 16.56% | ₹12,280 | ₹11,231 | ₹ 11,656 |

| Apr 24, 2023 | Last 1 Year | NA | NA | NA | NA | NA | NA | NA |

| Apr 24, 2021 | Last 3 Year | NA | NA | NA | NA | NA | NA | NA |

| Apr 24, 2019 | Last 5 Year | NA | NA | NA | NA | NA | NA | NA |

| Apr 24, 2014 | Last 10 Year | NA | NA | NA | NA | NA | NA | NA |

| Sep 08, 2023 | Since Inception | 10.0000 | 21.58% | 12.31% | 13.43% | ₹12,158 | ₹11,231 | ₹ 11,343 |

Disclaimer: MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY. Nifty 50 TRI (70%) + NIFTY Short Duration Debt Index (20%) + Domestic prices of Gold (8%) + Domestic prices of Silver (2%). As per SEBI circular no. SEBI/HO/IMD/DF3/CIR/P/2018/04 dated Jan 04, 2018, the performance of the scheme is benchmarked to the Total Return variant of the Index.The returns are simple annualized for less than 1 year. Different plans shall have a different expense structure. The performance details provided herein are of Regular Plan-Growth Option & Direct Plan-Growth Option.For computation of return since inception the allotment NAV has been taken as Rs. 10.00. Point-to-point returns on a standard investment of Rs. 10,000/- are in addition to CAGR for the Scheme.Past performance may or may not be sustained in future. Load is not considered for computation of returns. In case, the start/end date of the concerned period is a Non-Business Date (NBD), the NAV of the previous date is considered for computation of returns. The NAV per unit shown in the table is as on the start date of the said period.The scheme is being currently managed by Mr. Deepak Ramaraju along with Ms. Gargi Bhattacharyya Banerjee with effect from September 08, 2023.

Fund Portfolio

Sector Allocation

(as on 09 Feb 2024)

Equity

71.43%Debenture

3.30%Money Market Instruments

11.40%Others

13.87%

Sector Allocation

(as on 09 Feb 2024)

Petroleum Products

7.78%Banks

12.28%IT - Software

12.62%Construction

5.10%Automobiles

5.19%

Holdings (66)

| Name | Sector | Instrument | Assets |

|---|---|---|---|

| 364 Days T Bill 11-04-2024 | Sovereign | Money Market Instruments | |

| Reliance Industries Ltd. | Petroleum Products | Equity | |

| HDFC Bank Ltd. | Banks | Equity | |

| Infosys Ltd. | IT - Software | Equity | |

| Cash, Cash Equivalents and Net Current Assets | Others |

Holdings

(as on 09 Feb 2024)

Funds managed by

Mr Deepak Ramaraju

Mr. Deepak Ramaraju is a highly experienced Senior Fund Manager at Shriram Asset Management Company Ltd, with over two decades of diversified experience under his belt. He holds a degree in chemical engineering and has been associated with equity markets for the past 17 years. Before joining Shriram Asset Management Company, Mr. Deepak was part of the global equity research team and advised the Sanlam Group of South Africa on their India-focused fund. Prior to his stint in the financial industry, Mr. Deepak worked as a researcher and co-inventor at GE India Technology Center, Bangalore. During his time there, he was credited with 10 patents, highlighting his expertise and innovative abilities. His diverse background and extensive experience make him a valuable asset to the Shriram Asset Management team.

Funds managed by the fund manager

- Shriram Aggressive Hybrid Fund

- Shriram Flexi Cap Fund

- Shriram ELSS Tax Saver Fund

- Shriram Balanced Advantage Fund

- Shriram Overnight Fund

- Shriram Multi Asset Allocation Fund

Funds managed by Ms Gargi Bhattacharyya Banerjee

Ms. Gargi Bhattacharyya Banerjee serves as the Fund Manager of Shriram Mutual Fund having an experience of more than 20 years in her professional career. She received her Bachelor of Science with Economics (H) and Master of Business Management with specialization in Finance from the University of Calcutta. She joined as Research Manager in Shriram Asset Management Company Limited in November 2012 and before that, she has held key position in the Research team with Zacks Research Private Limited and Shriram Insight Share Brokers Limited.

Funds managed by the fund manager

- Shriram Aggressive Hybrid Fund

- Shriram Flexi Cap Fund

- Shriram ELSS Tax Saver Fund

- Shriram Balanced Advantage Fund

- Shriram Overnight Fund

- Shriram Multi Asset Allocation Fund

Sector Allocation

Petroleum Products

7.78%Banks

12.28%IT - Software

12.62%Construction

5.10%Automobiles

5.19%Telecom - Services

2.38%Power

1.50%Retailing

1.48%Auto Components

1.45%Aerospace & Defense

1.44%Consumer Durables

1.41%Finance

2.87%Consumable Fuels

1.20%Agricultural Food & other Products

1.06%Non - Ferrous Metals

1.04%Electrical Equipment

1.04%Oil

1.03%Insurance

1.00%Personal Products

0.99%Ferrous Metals

0.98%Pharmaceuticals & Biotechnology

3.83%Household Products

0.92%Diversified

0.52%Industrial Products

0.93%Realty

0.95%IT - Services

0.44%[ICRA]AAA

1.67%CRISIL AAA(CE)

0.72%CRISIL AAA

0.91%- 16.67%

Sovereign

8.60%

Fund Management

Mr Deepak Ramaraju

Managing this fund since 8 Sep 23

Mr Deepak Ramaraju

Managing this fund since 8 Sep 23Work Experience

21 yearsFund Managed

05Mr. Deepak Ramaraju is a highly experienced Senior Fund Manager at Shriram Asset Management Company Ltd, with over two decades of diversified experience under his belt. He holds a degree in chemical engineering and has been associated with equity markets for the past 17 years. Before joining Shriram Asset Management Company, Mr. Deepak was part of the global equity research team and advised the Sanlam Group of South Africa on their India-focused fund. Prior to his stint in the financial industry, Mr. Deepak worked as a researcher and co-inventor at GE India Technology Center, Bangalore. During his time there, he was credited with 10 patents, highlighting his expertise and innovative abilities. His diverse background and extensive experience make him a valuable asset to the Shriram Asset Management team.

Ms Gargi Bhattacharyya Banerjee

Managing this fund since 8 Sep 23

Ms Gargi Bhattacharyya Banerjee

Managing this fund since 8 Sep 23Work Experience

22 yearsFund Managed

05Ms. Gargi Bhattacharyya Banerjee serves as the Fund Manager of Shriram Mutual Fund having an experience of more than 20 years in her professional career. She received her Bachelor of Science with Economics (H) and Master of Business Management with specialization in Finance from the University of Calcutta. She joined as Research Manager in Shriram Asset Management Company Limited in November 2012 and before that, she has held key position in the Research team with Zacks Research Private Limited and Shriram Insight Share Brokers Limited.

See all schemes managed by

Deepak Ramaraju

Mr. Deepak Ramaraju is a highly experienced Senior Fund Manager at Shriram Asset Management Company Ltd, with over two decades of diversified experience under his belt. He holds a degree in chemical engineering and has been associated with equity markets for the past 16 years. Before joining Shriram Asset Management Company, Mr. Deepak was part of the global equity research team and advised the Sanlam Group of South Africa on their India-focused fund. Prior to his stint in the financial industry, Mr. Deepak worked as a researcher and co-inventor at GE India Technology Center, Bangalore. During his time there, he was credited with 10 patents, highlighting his expertise and innovative abilities. His diverse background and extensive experience make him a valuable asset to the Shriram Asset Management team.

Funds managed by the fund manager

- Shriram Aggressive Hybrid Fund

- Shriram Flexi Cap Fund

- Shriram ELSS Tax Saver Fund

- Shriram Balanced Advantage Fund

- Shriram Overnight Fund

- Shriram Multi Asset Allocation Fund

See all schemes managed by Gargi Bhattacharyya Banerjee

Ms. Gargi Bhattacharyya Banerjee serves as the Fund Manager of Shriram Mutual Fund having an experience of more than 20 years in her professional career. She received her Bachelor of Science with Economics (H) and Master of Business Management with specialization in Finance from the University of Calcutta. She joined as Research Manager in Shriram Asset Management Company Limited in November 2012 and before that, she has held key position in the Research team with Zacks Research Private Limited and Shriram Insight Share Brokers Limited.

Funds managed by the fund manager

- Shriram Aggressive Hybrid Fund

- Shriram Flexi Cap Fund

- Shriram ELSS Tax Saver Fund

- Shriram Balanced Advantage Fund

- Shriram Overnight Fund

- Shriram Multi Asset Allocation Fund

Fund House

Shriram Asset Management Co Ltd.

217, 2nd floor, Swastik Chamber, Near junction of S.T. & C.S.T. road, Chembur, Mumbai - 400 071

customercare@shriramamc.co.in

Contact

Investor – 18604191200

Distributor - 18604191400

Frequently Asked Questions

What is Shriram Multi Asset Allocation Fund?

An open ended scheme investing in Equity, Debt & Money Market Securities and Gold/Silver ETF’s and related instrument

What is the investment objective?

The primary objective of the scheme is to generate long term capital appreciation with inflation beating returns by investing in Equity and Equity related securities, Debt and Money Market instruments, Gold/Silver ETFs and REITs/InvITs. There is no assurance that the investment objective of the Scheme will be achieved.

What is the suitability of this scheme?

This fund is suitable for investors who are seeking - Long Term inflation adjusted wealth creation through exposure to multiple assets i.e., Equity, Debt and Gold/Silver ETFs

To regularly invest over time through SIPs, top-ups or STP from liquid/overnight funds to meet financial and family goals. What is the fund management process & investment style?

The fund follows a combination of Quant and Fundamental investment approach for stock and sector selection. Portfolio construction shall be done using valuation, underlying risks and diversification. Asset allocation shall be done using relative valuation of the underlying asset class, macro factors, etc.

What is asset allocation of the fund?

The fund will invest a minimum of 65% and maximum of 80% in Equity and Equity related securities, minimum of 10% and maximum of 25% in Debt and Money Market Instruments and Cash and a minimum of 10% and maximum of 25% in Gold/Silver ETFs and up to 10% in the units issued by REITs and InvITs.

Who is the Fund manager of the scheme?

The fund shall be managed by Mr. Deepak Ramaraju along with Ms. Gargi Bhattacharyya Banerjee.

How has the fund performed?

Shriram Multi Asset Allocation Fund has been in existence for less than 6 months, hence the performance of the scheme has not been provided

What is the minimum investment amount?

During the NFO period and on an ongoing basis, the minimum investment amount is Rs.5000/- and in multiples of Re. 1/- thereafter. Under the Systematic Investment Plan, the minimum amount is Rs.1000/- per month and Rs.3000/- quarterly and in multiples of Re. 1/- thereafter

Is there any entry/exit load?

Entry Load: There is no entry load

Exit Load: If redeemed / switched-out within 90 days from the date of allotment: - Upto 12% of units: Nil - More than 12% of units: 1% of applicable Net Asset Value (NAV) If redeemed/switched-out after 90 days from the date of allotment: Nil

What is the tax treatment of Shriram Multi Asset Allocation Fund?

Long term capital gains exceeding Rs.1 lakh shall be taxed at the rate of 10% without allowing the benefit of indexation.

Disclaimer: MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY. With regard to taxation, investors are advised to consult their tax consultants to know the consequences of tax, if any. Income Tax benefits to the mutual fund & to the unit-holder are in accordance with prevailing tax law. The investor shall be solely responsible for any action taken based on this document. Shriram Mutual Fund, Shriram Asset Management Company Limited, Board of Trustees-Shriram Mutual Fund and their associates shall not be liable in any manner for the consequences of such action taken by the investor.

Risk Factors: All investments in mutual funds and securities are subject to market risks and the NAV of the Scheme may go up or down depending upon the factors and forces affecting the securities market. There can be no assurance that the Scheme's investment objective will be achieved. The past performance of the Mutual Fund is not indicative of the future performance of the Scheme. The scheme inception date is 8th September 2023. The Sponsor is not responsible or liable for any loss resulting out of the operation of the Scheme beyond the initial contribution of Rs.1 Lakh made towards setting up the Mutual Fund. Shriram Multi Asset Allocation Fund is only the name of the Scheme and does not in any manner indicate the quality of the Scheme or its future prospects or returns. There is no guarantee or assurance as to any return on investment of the unit holders. The investments made by the Scheme are subject to external risks on transfer, pricing, trading volumes, settlement risks, etc. of securities. Please refer to the Offer Document/Statement of Additional Information/Key Information Memorandum of the scheme before investing.