Shriram Mutual Funds Investment Have the Potential to Turn Your Dream Home Into Reality

Overview

Building dreams, one brick at a time. Invest in a brighter tomorrow with a mutual fund that’s designed to make homeownership a reality. We understand the significance of this goal, and that’s why we’re dedicated to supporting you every step of the way. Invest with us today and let’s build your dream home together. Your future starts now with Shriram mutual funds.

How can inflation affect your future?

Today₹ 111.3

At retirement ₹ 158.87

Today₹ 7,500

At retirement₹ 19,500

Today₹ 23,250

At retirement₹ 57,550

Today₹ 8,700

At retirement₹ 16,550

Today₹ 3,750

At retirement₹ 12,825

Today₹ 5,270

At retirement₹ 17,570

Benefits of Investing in Shriram Mutual Funds to buy a Dream Home

Who should Invest in Shriram Mutual Fund for Dream Home

- Future homebuyers who are planning to buy a home in the foreseeable future.

- Existing homeowners looking to extend or renovate their homes.

- Long-term Investors looking to build a large corpus on a longer time horizon.

- Renters looking to buy their first home.

- Investors seeking diversification by looking to invest in real estate or housing sector

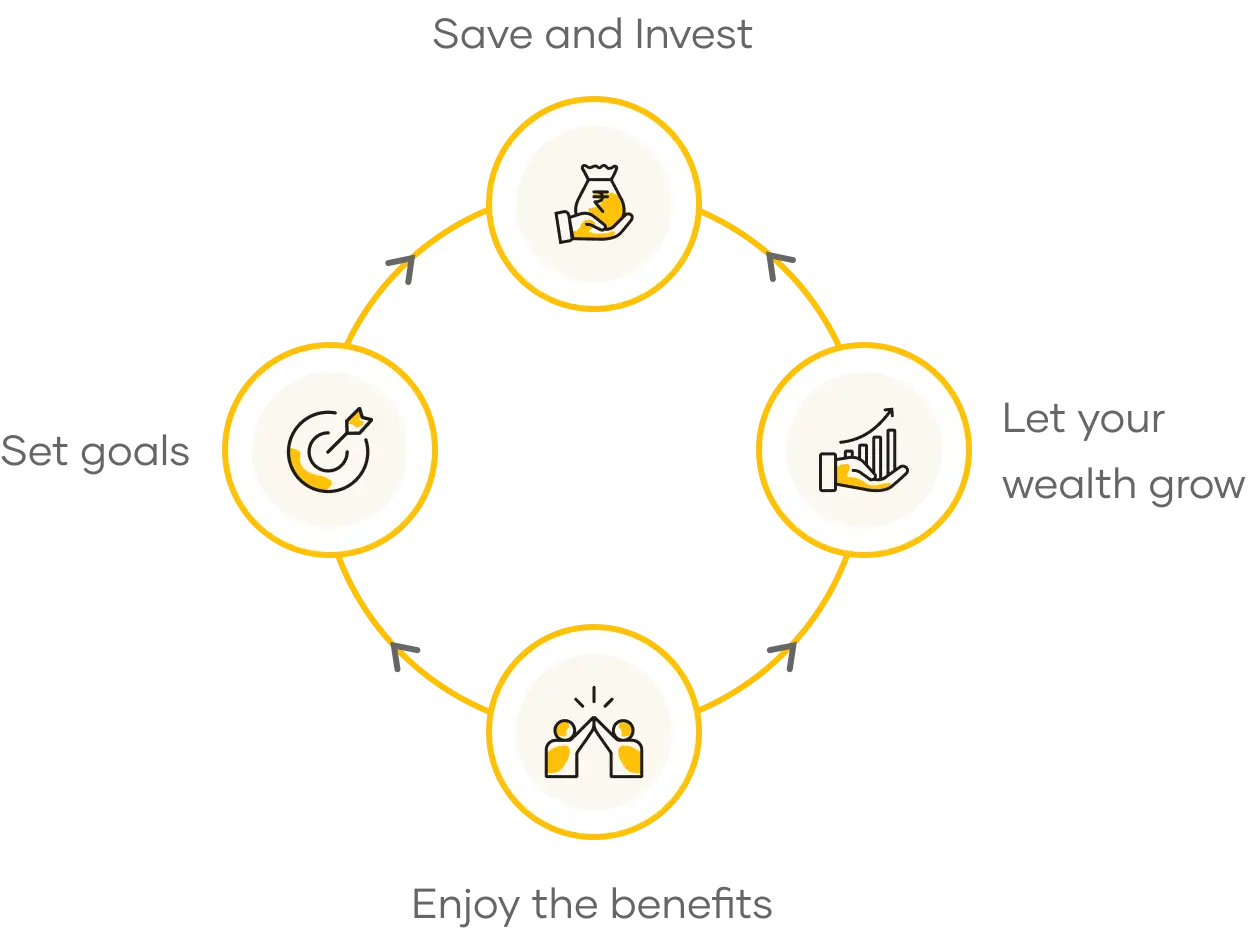

How to Invest in Shriram Mutual Fund for Dream Home

Step 01

Use our dream home planning calculator to find out investment for a home.Step 02

Register and create a folio by completing KYC verification and bank account authentication.Step 03

Select the mutual fund you wish to invest in.Step 04

Choose SIP or lump sum and make the payment.Step 05

Receive a confirmation of your investment.

Frequently Asked Questions

How to invest in a dream home?

To invest for your dream home, follow these steps:

- Determine the amount you need to save for your dream home.

- Assess your risk tolerance and investment horizon.

- Consider investing in mutual funds to grow your savings.

- Set up Systematic Investment Plan (SIP) to invest regularly.

- Monitor your investments and revise your strategy as needed.

Which mutual fund is best for home investment?

The best mutual fund for home investment depends on factors such as your risk tolerance, investment goals, and time horizon. Look for mutual funds that align with your investment preferences.

Which mutual fund house is safest?

Mutual fund safety is subjective and depends on various factors, including the fund's investment strategy, risk management practices, and regulatory compliance. Look for fund houses with a strong reputation, experienced fund managers, and a disciplined investment approach. Consider fund houses that are well-established, have a robust risk management framework, and adhere to regulatory guidelines.

Which is the best mutual fund to buy a dream house?

The best mutual fund to buy a dream house depends on your investment objectives, risk tolerance, and investment horizon. Look for fund houses with strong credibility, experienced fund managers, and a solid investment strategy.