For Every Wedding Wish, There’s a Mutual Fund! Invest in Shriram Mutual Funds

Overview

Destination wedding or a homely celebration- planning a wedding can be an expensive affair, but it doesn't have to be. Planning a grand wedding is a dream for many. However, with rising living costs and inflation, managing your wedding expenses can be quite challenging without proper planning. To achieve your dream wedding, consider it a financial goal and start investing in mutual funds now.

How can inflation affect your future?

Today₹ 111.3

At retirement ₹ 158.87

Today₹ 7,500

At retirement₹ 19,500

Today₹ 23,250

At retirement₹ 57,550

Today₹ 8,700

At retirement₹ 16,550

Today₹ 3,750

At retirement₹ 12,825

Today₹ 5,270

At retirement₹ 17,570

Benefits of Investing in Shriram Mutual Funds for Wedding Plan

Who should invest in Shriram Mutual Fund for Wedding Plan?

- Future-focused couples looking for a dream wedding.

- Parents of the bride and groom looking to build a wedding corpus.

- Individuals looking to start small by embracing systematic investments.

- Goal and benefit-oriented individuals looking to save while seeking tax benefits.

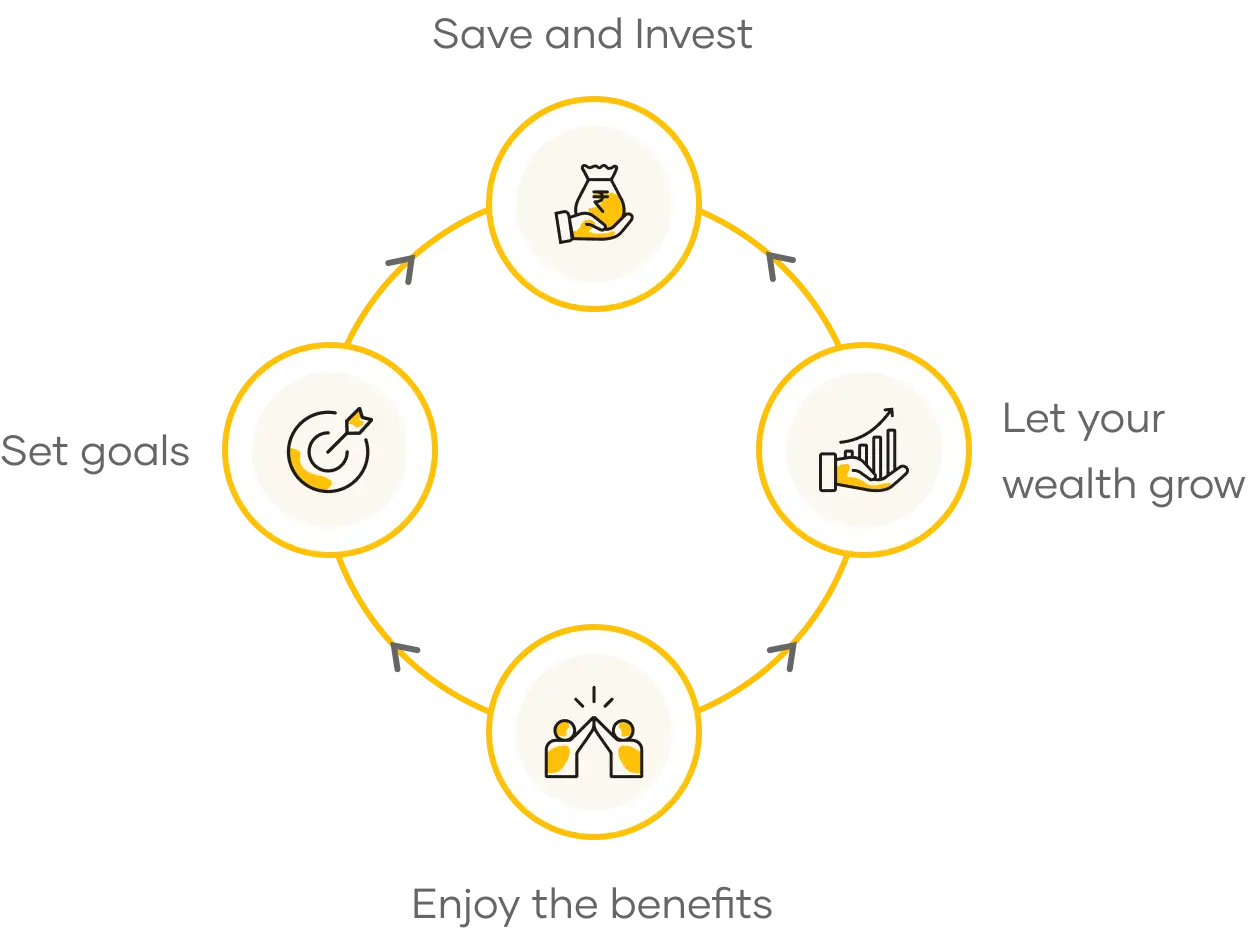

How to fund your wedding using Shriram Mutual Fund?

Step 01

Use our mutual funds for wedding planning calculator to find out investment.Step 02

Register and create a folio by completing KYC verification and bank account authentication.Step 03

Select the mutual fund you wish to invest in.Step 04

Choose SIP or lump sum and make the payment.Step 05

Receive a confirmation of your investment.

Frequently Asked Questions

What is a mutual fund for wedding planning?

A mutual fund for wedding planning is a type of investment fund that allows you to invest your money in various securities with the goal of creating a wedding fund.

How does a mutual fund for wedding planning work?

A mutual fund for wedding planning works by pooling investors' money together and investing it in various securities, such as stocks and bonds, to generate returns over time.

Is it a good idea to invest in mutual funds for my daughter's or son’s wedding?

Investing in mutual funds for your daughter's wedding can be a smart financial move, as it can help you build a wedding fund over time and potentially earn higher returns than traditional savings accounts.

Can mutual funds be used to fund my own wedding?

Yes, mutual funds can be used to fund your own wedding. By investing in mutual funds specifically for a wedding, you can potentially earn higher returns and build a wedding fund over time. Moreover, SIPs or systematic investment plans can help you build a considerable corpus by allowing you to invest a specific amount every month towards your wedding goals.

How do I invest in mutual funds for a wedding?

To invest in mutual funds for a wedding, you can start by researching mutual fund options that align with your investment goals and risk tolerance. You can then open a mutual fund account and begin investing through SIPs or lump sum investments. You can also use our mutual funds for wedding planning calculator to plan the budget for you wedding.

What are the risks of investing in mutual funds for a wedding?

Like any investment, investing in mutual funds for a wedding carries risks, such as market fluctuations and potential loss of principal. However, investing in mutual funds with a long-term perspective and through SIPs can help mitigate these risks.

How much should I invest in mutual funds for a daughter's wedding?

The amount you should invest in mutual funds for a daughter's wedding will depend on your financial situation and wedding goals. It's important to determine a realistic budget and invest accordingly, keeping in mind your risk tolerance and time horizon.

What is the best way to get started with investing in mutual funds for a wedding?

The best way to get started with investing in mutual funds for a wedding is to do your research, determine your investment goals and risk tolerance, and work with a financial advisor or mutual fund provider to select the best mutual fund options for your needs. You can then begin investing through SIPs or lump sum investments.